irs.gov unemployment tax refund status

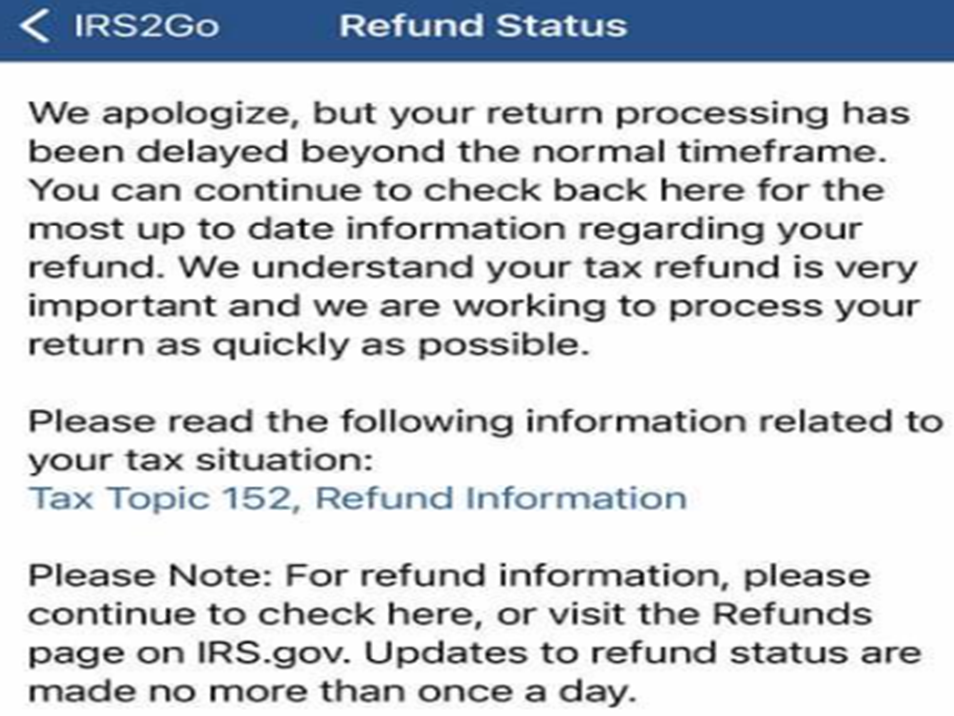

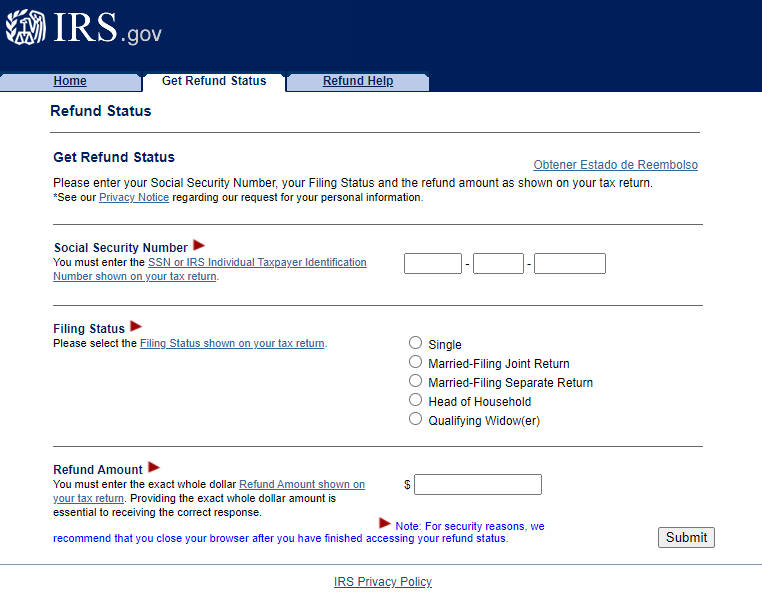

If you were expecting a federal tax refund and did not receive it check the IRS Wheres My Refund page. Viewing the details of your IRS account.

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

Notify the IRS of an address or name change to make sure the IRS can process your tax return send your refund or contact you if needed.

. The Federal Unemployment Tax Act FUTA with state unemployment systems provides for payments of unemployment compensation to workers who have lost their jobs. Ad Learn How Long It Could Take Your 2021 Tax Refund. Check the status of your.

Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. Go to My Account and click on RefundDemand. 14the agency had sent more than 117 million refunds worth 144.

The IRS will continue reviewing and adjusting tax returns in. You can also request a copy of your transcript by mail or through the IRS. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

View Refund Demand Status. How to File Taxes After Receiving Unemployment. WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million.

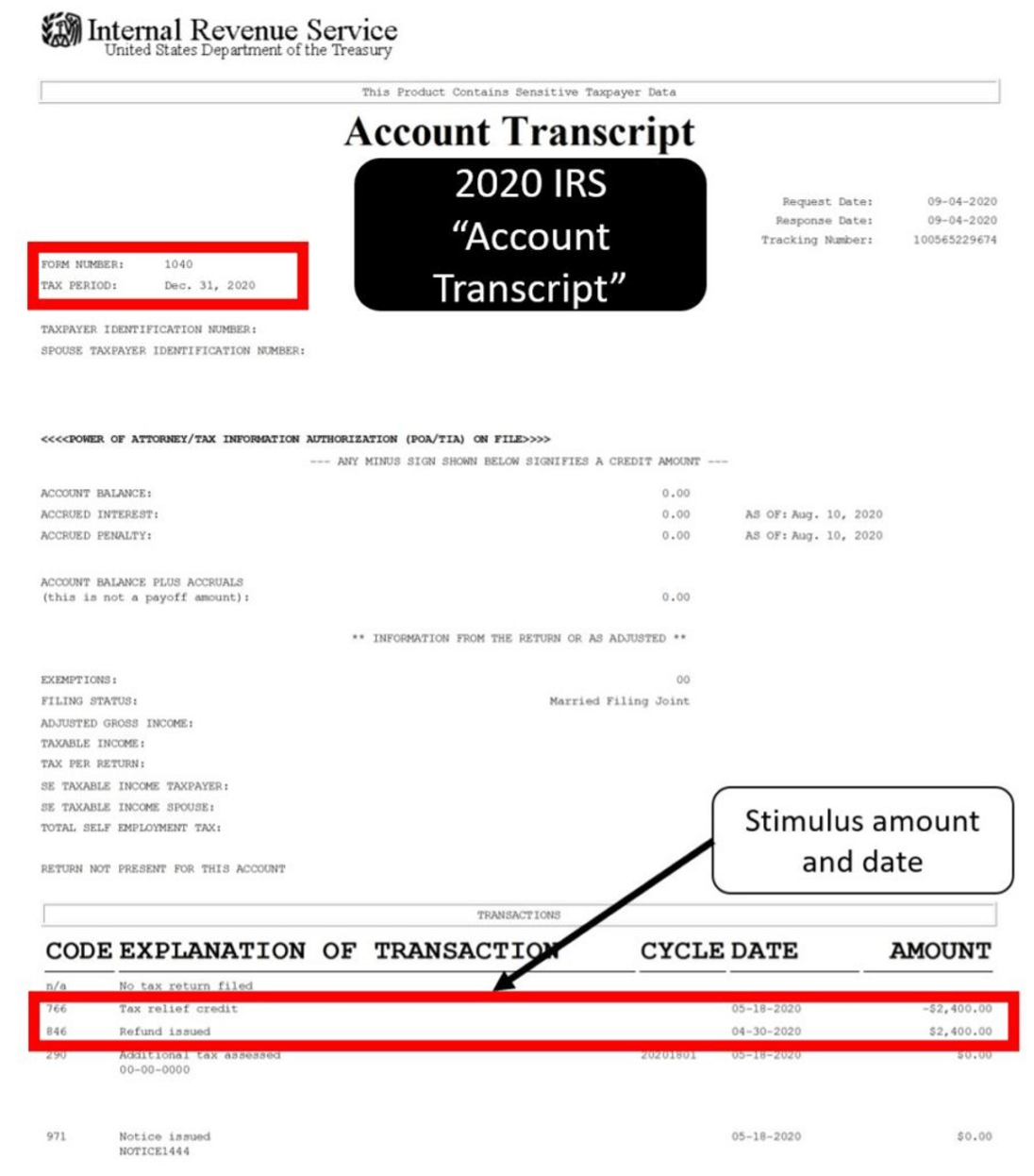

Youll need to enter your Social Security number filing status and the. IR-2021-151 July 13 2021. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records.

The IRS continues to review tax year 2020 returns and process corrections for taxpayers who paid taxes on. Because the change occurred after some people filed their taxes the IRS will take steps in the spring and. The IRS said it has already issued more than 118 million refunds totaling 145 billion related to the unemployment tax break.

Unemployment compensation is intended to provide benefits to employees who lose their jobs through no fault of their own. These letters are sent out. Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha.

Status On Irs Unemployment Tax Refund - However the irs is now in the process of sending out tax rebates to rectify that. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. IR-2021-159 July 28 2021 The Internal Revenue Service.

Here is more information about unemployment. Using the IRSs Wheres My Refund feature. Since May the IRS has issued over 87 million unemployment compensation refunds totaling over 10 billion.

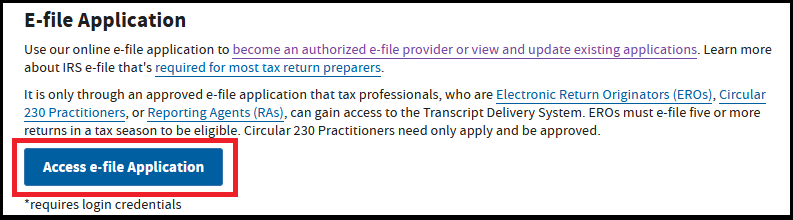

Some taxpayers will receive refunds which will be issued periodically and some will have the overpayment applied to taxes due or other debts. Check Your Amended Return Status. Access online tools for tax professionals register for or renew your Preparer Tax Identification Number PTIN apply for an Electronic Filing Identification Number EFIN and.

For some there will be no change. In the latest batch of refunds announced in november however the average was 1189. An immediate way to see if the IRS processed your refund is by viewing your tax records online.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. The IRS began performing the corrections starting in May 2021 and continues to review tax year 2020 returns and process corrections to issue any applicable refund that is due. The legislation excludes only 2020 unemployment benefits from taxes.

Status of Unemployment Compensation Exclusion Corrections. You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income section.

Covid19 Links For Taxpayers San Diego County Taxpayers Association

Taxes 2022 Child Tax Credit Stimulus Checks Impact 2022 Tax Refunds

Irs Transcripts Now Provide Stimulus Payment Information Jackson Hewitt

Tax Refund Stimulus Help Facebook

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Some May Receive Extra Irs Tax Refund For Unemployment

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

Irs Will Recalculate Taxes On 2020 Unemployment Benefits

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Can The Irs Take Or Hold My Refund Yes H R Block

Millions Of Americans Won T See Their Tax Refunds For Months Time

Refunds Internal Revenue Service

Modifying Your Irs E Services Application To E File Forms 94x Forms 941 940 Etc Cfs Tax Software Inc

Tax Refund Status Is Still Being Processed

Irs Third Round Of Economic Impact Payments Going Out Va News

2012 Instructions For Form 940 Internal Revenue Service

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Internal Revenue Service An Official Website Of The United States Government